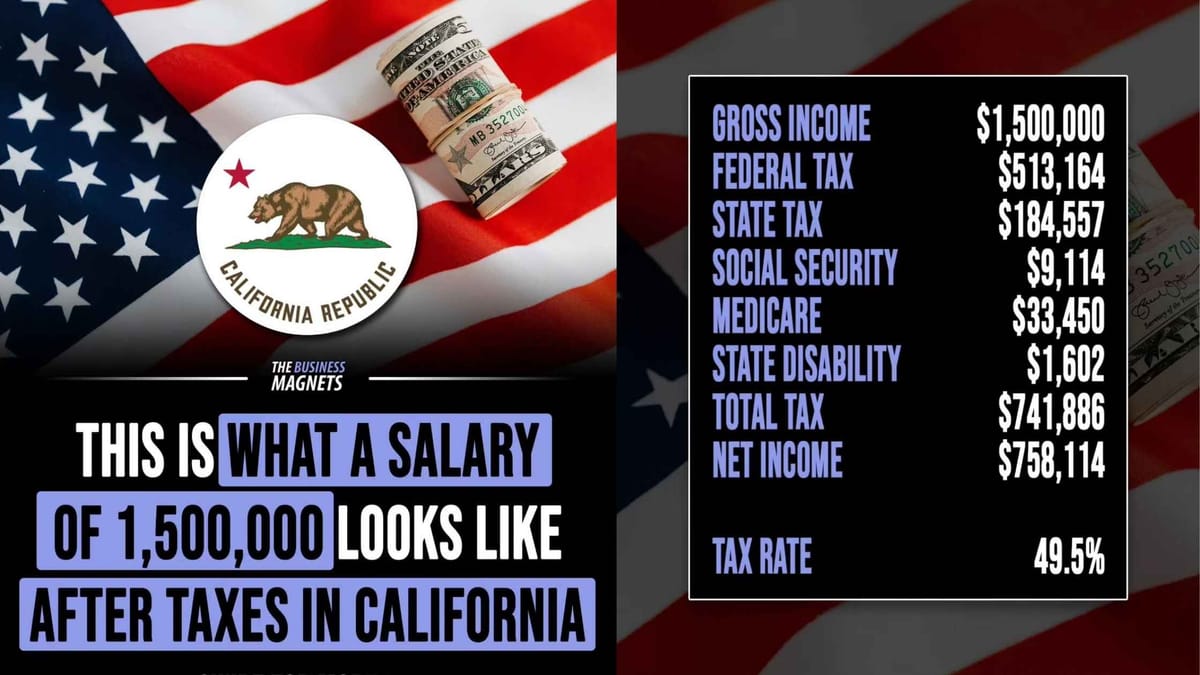

What a $1.5 Million Salary Looks Like After Taxes in California

For high-income earners in California, the combination of federal and state taxes can significantly reduce take-home pay. Let’s dive into what happens to a $1,500,000 salary and break down where the money goes.

From Gross Income to Net Income

Earning $1.5 million annually sounds impressive, but taxes tell a different story. Here’s the breakdown:

- Gross Income: $1,500,000

- Total Taxes Paid: $741,886

- Net Income: $758,114

In other words, nearly half of the earnings – precisely 49.5% – goes to taxes. Here’s a closer look at how these deductions are calculated:

Tax Breakdown: Where Does the Money Go?

- Federal Taxes

- Top Tax Rate: For earnings over $693,750, the federal rate reaches 37%.

- Federal Tax Total: $513,164

- California State Taxes

- Top State Tax Rate: California leads the nation with the highest state income tax at a top rate of 13.3%.

- Millionaire Surtax: High-income earners face a 1% surtax on earnings above $1,000,000.

- State Tax Total: $184,557

- Additional Deductions

- Social Security: $9,114

- Medicare: $33,450

- State Disability Insurance (SDI): $1,602

- Total Taxes Paid: $741,886

Marginal Tax Rate vs. Average Tax Rate

While the average tax rate on a $1.5 million income is 49.5%, the marginal tax rate (the tax on each additional dollar earned) is even higher at 52.9%. This means that more than half of any additional income above $1.5 million goes directly to taxes.

Why Are California Taxes So High?

California’s progressive tax system ensures that higher earners pay significantly more. Here’s why:

- Top State Tax Rate: California’s highest rate is 13.3%.

- Millionaire Surtax: An extra 1% surtax applies to incomes exceeding $1 million.

- Federal Rates: Income over $693,750 is taxed at the federal rate of 37%.

Combined, these factors make California one of the most tax-heavy states for high earners.

Is a $1.5 Million Salary Still Worth It?

Despite losing nearly half to taxes, earning $1.5 million still provides a substantial take-home income of $758,114. To make the most of this income, careful financial planning is key:

- Maximize Tax Deductions: Leverage retirement contributions, charitable donations, and business expenses.

- Consider Relocation: Some individuals move to states with no income tax, such as Texas, Florida, or Nevada.

The Bigger Picture: Why High Earners Stay in California

California remains a magnet for top talent across industries like tech, entertainment, and finance. While taxes are steep, the state offers unmatched opportunities, access to global business hubs, and an enviable lifestyle.

For many, the trade-off is worth it.

Final Thoughts

Earning $1.5 million annually in California highlights the challenges and rewards of high income. While taxes claim nearly half of the salary, a net income of $758,114 still provides financial comfort and opportunities for strategic growth.

Understanding these numbers is key to planning for success. Stay tuned to The Business Magnets for expert insights on financial strategies, tax breakdowns, and income trends for top earners across the United States.